Understanding Council Tax Bands: Your First Step to Savings

What Exactly is Council Tax Banding?

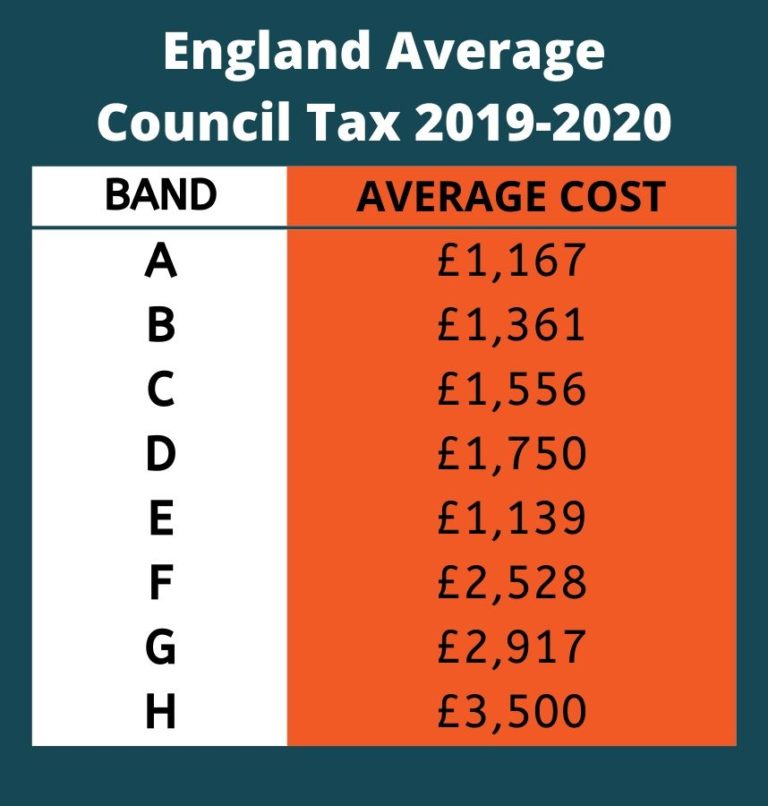

Navigating the labyrinth of local taxation can feel like deciphering ancient hieroglyphs, can’t it? Let’s start with the basics: council tax banding. In essence, it’s a valuation of your property, used by your local council to determine how much council tax you owe. These bands, typically ranging from A to H (or even I in some areas), are based on the property’s market value as of a specific date, usually 1991 in England and Scotland, and 2003 in Wales. It’s a snapshot of a bygone era, which sometimes leads to… interesting discrepancies. Think of it as a retro valuation, if you will.

The system is designed to be progressive. Higher-value properties fall into higher bands, meaning their owners pay more council tax. This money funds essential local services like refuse collection, schools, and social care. The idea is simple: those with more contribute more. But, as with any system, it’s not without its quirks. A property that’s seen significant changes since those valuation dates might be in the wrong band, hence the importance of checking.

Why does this matter to you? Well, if your property is in a higher band than it should be, you’re essentially overpaying. Imagine finding out you’ve been paying extra for years – a bit like discovering you’ve been tipping 25% when you thought it was 10%, every single time. Checking your band can potentially save you a significant amount of money annually. And who wouldn’t like a bit of extra cash?

Remember, the band isn’t based on what you paid for the property today, but on its estimated value from decades ago. This historical context is crucial when you start to investigate whether your band is correct. It’s not about current market fluctuations, but about a snapshot of the past. So, put on your detective hat, and let’s get to it!

How to Find Your Current Council Tax Band

The Official Valuation Office Agency (VOA) and Scottish Assessors Website

Alright, so you’re ready to dive in. The most reliable place to start is the official source. In England and Wales, that’s the Valuation Office Agency (VOA) website. In Scotland, it’s the Scottish Assessors website. These sites are your primary tools for checking your current council tax band. They’re designed to be user-friendly, even if you’re not a tech whiz. Think of them as your official council tax band decoder rings.

These websites allow you to search for your property by postcode or address. Once you’ve located your property, the site will display its current council tax band. This is the band your local council uses to calculate your bill. It’s like checking your credit score, but for your house—a vital piece of financial information. The information provided is usually quite detailed, including the date of the original valuation and other relevant data.

Using these official websites ensures you’re getting accurate and up-to-date information. Avoid relying on third-party websites or unofficial sources, as they may not be reliable. Think of it as going to the doctor instead of asking your neighbor for medical advice. The VOA and Scottish Assessors are the experts in this field. They have the official data, and they are the best place to get your informaiton.

Additionally, these websites often provide information about how to challenge your band if you believe it’s incorrect. You might not need to challenge, but knowing how to do so is like having a spare key—you hope you won’t need it, but it’s good to have just in case. They are also often updated with new information, so if you are unsure, you can always recheck.

Challenging Your Council Tax Band: Is It Worth It?

When to Consider a Challenge

So, you’ve checked your band and you think it’s wrong. What’s next? Challenging your council tax band is a significant step, and it’s not always a simple process. But if you have solid evidence, it can be well worth the effort. It’s a bit like appealing a parking ticket—if you’re in the right, you should fight for it.

You should consider challenging your band if you believe your property’s value was significantly overestimated in 1991 (or 2003 in Wales). Common reasons include significant structural changes to the property, such as demolition of parts of the building, or if similar properties in your area are in lower bands. It’s like finding out your neighbor’s house, identical to yours, is paying less—that’s a red flag.

Before launching a formal challenge, gather as much evidence as possible. This includes photographs, valuation reports, and any other documentation that supports your claim. You’ll need to demonstrate that your property’s value was lower than the band suggests at the relevant valuation date. It is like preparing for a court case; you need to have all of your evidence ready. It is important to be thorough.

Remember, challenging your band can result in it being lowered, but it can also be increased if the valuation is found to be too low. So, proceed with caution and ensure you have a strong case. It’s like a double-edged sword—use it wisely. And if you are unsure, get expert advice.

The Impact of Property Changes on Council Tax Bands

Renovations, Extensions, and Conversions

Property changes can significantly impact your council tax band. If you’ve made substantial alterations to your home, such as building an extension or converting a garage into living space, your property’s value might have increased. This could potentially push it into a higher band. It’s like leveling up your house, but with potential tax implications.

However, not all changes trigger a revaluation. Minor renovations, such as replacing windows or updating the kitchen, typically don’t affect your band. The key is whether the changes have significantly altered the property’s market value. If you’ve added a whole new wing, that’s a different story than a new coat of paint. Think of it as the difference between a facelift and a full-blown reconstruction.

It’s important to keep records of any major property changes. This documentation can be crucial if you need to challenge your band in the future. It’s like keeping a diary of your house’s life, which can be very useful if questions arise. If you have done work, keep the records.

If you’re unsure whether your changes have affected your band, it’s best to contact your local council or the VOA for advice. They can provide guidance on whether a revaluation is necessary. It is always better to ask, than to guess.

Tips for a Smooth Council Tax Band Check

Staying Organized and Informed

Checking your council tax band doesn’t have to be a daunting task. With a bit of organization and preparation, you can streamline the process. Keep all your documents related to your property in one place, including valuation reports, renovation records, and council tax bills. It’s like having a filing cabinet for your house, keeping everything in order.

Stay informed about any changes to council tax regulations or valuation practices. Local councils and the VOA often publish updates on their websites. Subscribing to their newsletters or following them on social media can help you stay up-to-date. It is useful to be informed.

If you’re considering challenging your band, seek professional advice. A surveyor or valuation expert can provide an independent assessment of your property’s value, which can strengthen your case. It is like hiring a lawyer, they know the law, and can help you win your case.

Remember, checking your council tax band is a proactive step towards managing your finances. It’s about ensuring you’re paying the correct amount and not a penny more. Approach it with a sense of calm and diligence, and you’ll be well on your way to saving money. It is a good process, and you can save money.

Frequently Asked Questions (FAQs)

Your Council Tax Band Queries Answered

Q: How often can I check my council tax band?

A: You can check your council tax band as often as you like. There are no restrictions. However, you can only challenge it under certain circumstances, such as when you move into a new property or if there have been significant changes to your property.

Q: What happens if my challenge is successful?

A: If your challenge is successful, your council tax band will be lowered, and you may be entitled to a refund of overpaid council tax. The refund period varies, but it’s typically backdated to when you moved into the property or when the changes were made.

Q: Can my council tax band go up after a challenge?

A: Yes, it’s possible. If the valuation office finds that

What Are The Council Tax Bands In Cornwall? Historic Cornwall

Council Tax 20152016 Cse News

Council Tax Banding For Hmo’s Government Consultation

Council Tax Change Of Address In 3 Minutes

Council Tax In Scotland How To Check Your Band As Most